You Are Here

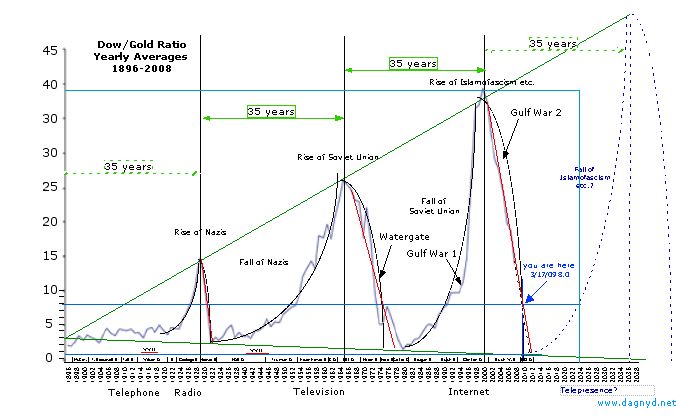

The Dow (DJIA) to Gold (Au) ratio: You can think of the ratio as the balance between enthusiasm and fear. When we are enthusiastic for our financial prospects, the Dow is higher. When we have financial fear of losing our assets, we value gold more. While gold is not a productive asset, it is a relatively safe one. In contrast, investing in business and the Dow is a productive asset, but a relatively unsafe one. You can also consider the ratio to be the changes in the Dow corrected for inflation by basing it on gold or Dow per unit of gold.

The Great Depression, the Carter Stagflation, and the Bush-Obama Downturn all follow a pattern that is striking: The economic peaks are separated by almost exactly 35 years. There are also suggestive patterns in politics, military affairs, and technology, all of which are tied into the repeating pattern.

Perhaps we can use this to see where we are and where we will go financially, politically, and technologically.

Written by Dagny D'Anconia

Tuesday 17 March 2008

This economic downturn has us all wondering when it will end, how bad will it get, and what will it do to our personal wealth. In order to understand and predict, we need to look to history. One measure in particular is tremendously useful in this: The Dow (DJIA) to Gold (Au) ratio. You can think of the ratio as the balance between enthusiasm and fear. When we are enthusiastic for our financial prospects, the Dow is higher. When we have financial fear of losing our assets, we value gold more. While gold is not a productive asset, it is a relatively safe one. In contrast, investing in business and the Dow is a productive asset, but a relatively unsafe one. You can also consider the ratio to be the changes in the Dow corrected for inflation by basing it on gold or Dow per unit of gold.

(For a higher resolution image click here.)

Looking at the graph you can see that there have been striking peaks in the ratio. The Great Depression, the Carter Stagflation, and the Bush-Obama Downturn all follow a pattern that is striking: The economic peaks are separated by almost exactly 35 years. They linearly increase in maximum magnitude each time there is a peak, and the point of origin is near the start of the growth of industry in late 1890's America.

These economic cycles look very much like a repeating phenomenon. It appears to be out of control enthusiasm which hits a gradually increasing limit, and then has out of control crashes. A physicist would look at it and probably say it looks more like out of control positive feedback loop of increasing magnitude: Each increment of market enthusiasm led to even more enthusiasm while each decrement of less market enthusiasm led to even less. The higher the Dow/Au ratio goes up at the peak, the farther down it falls at the bottom. This fits with my recent article "The World Wide Government Bubble" which made the argument that we are in an out of control positive feedback loop that transcends politics.

Not only does the graph allow some useful projections for our future; the patterns that emerge from the graph are quite useful regarding our past and the phenomenon we are caught up in. For example:

The 35 Year Cycle

Clearly something is special about 35 years because this boom bust cycle seems to repeat every 35 years. The cause may lie in when we were born and what part of the cycle makes a mental impression on us. A young adult is first starting out on a career and family around age 25. He retires about 35 years later around age 60. Thus the typical productive life span is about 35 years. The cohort that is in power running the show will be pretty much gone 35 years later. Perhaps along with this 'changing of the guard' there is a changing of attitude from boom mentality to bust mentality.

At least in my family, those that were first setting out as young adults during the pit of a cycle became serious minded Conservative Republicans, while those that were first setting out on their own during a boom became Liberal Democrats. My mother, daughter and I all became young adults in the pit of either the Depression, or the Carter Stagflation, or the present economic downturn, and all are Conservative Republicans. We are and were impressed by the need for frugality and became very productive. My Liberal Democrat brother and several nephews were just starting their careers and families in the easy boom times of the late 50's, or 80's to 90's. They had it easy and are much less industrious and serious about life. Perhaps it is just a coincidence in my family, but when you are born in a cycle may affect how you view life and your political inclinations.

Those who have little wealth because they are just starting their careers and families will struggle to make ends meet in a crash. They have a restraining influence on the economy for some time - 35 years - until they too retire and the cycle repeats. There is a tipping point where the frugal are replaced by the careless and fearless who then run the system into the ground. The cultural memory of economic fear fades and has to be relearned in another crash.

The Gradually Increasing Peaks and Pits

The peaks gradually increase in a linear fashion. Perhaps this is because the increase in technology allows higher and higher levels of economic insanity to be sustainable. The higher it goes before it is unsustainable the farther it falls to the bottom in the crash.

Military Threats

During the times of rising economic enthusiasm some of the worse threats to America arose. The Nazi's rose in power during the peak before and grew in power through the Great Depression. The Soviet Union rose in power during the peak and fall of the Carter Stagflation. In our most recent peak and fall we witnessed the rise of Islamofascism with Ahmadinejad and AlQaeda, Putin's New Russia, Hugo Chavez's aggressive new socialism, and the rise of mercantile China.

America was weakened during those peaks and subsequent falls, perhaps leading to emboldened enemies. While America partied, was unserious, and focussed on economic booms, she created an opportunity for her enemies to gain power. As America lost economic power, she lost influence over world events allowing the ambitions of tyrants to flourish.

Politics

The most reviled of presidents occurred on the downswing and they were Republicans: Hoover, Nixon, and W. Bush. Democrat Carter also rode the economy down after a short wobble during the brief Ford presidency.

FDR, Carter, and Obama were all elected near their pit, and they were all big time spender Democrats. Indeed today we note the similarities between them. Obama is well on his way to being as reviled as Carter, and he is catching the economic drop as Carter and Nixon did.

Notice near the peak of the economic upswing we had presidents that were party animals. The adulterous promiscuity of Kennedy with Marilyn Monroe and the peccadilloes of Billy Clinton were very similar. Remember the press adulation of Camelot and the Clinton White House, and the heavy drug use of both Kennedy and Clinton. Both were lust and drug filled Democrats that rode to the peak. During the lead up to the Great Depression Harding (a Republican) was elected and like Clinton and Kennedy, had numerous affairs and corruption. Like Clinton he used a small room adjacent to the oval office for affairs. He died shortly after widespread corruption was revealed in his administration. Cooledge (his vice president with no hint of scandal) became president, but was not therefore "elected" in this time period but he was re-elected as the boom continued.

After the pit we elected Democrat Truman and Republican Eisenhower in large part because of the Second World War. We elected Republican Reagan largely because of the Cold War. All three had a down-to-earth fatherly appeal and an aggressive attitude toward America's enemies. Each had seen the rise of threats against America and rose to confront them.

Perhaps this economic phenomenon moves the voters to elect certain kinds of people at certain times of the cycle: Only a grinning incompetent like Democrats Jimmy Carter or Obama could be elected as we head to the bottom. Only a sex crazed adolescent drug party animal could be elected for the ride to the top. Only a Republican straight laced tough corporate business man style president could be elected for the fall from the top (Hoover, Nixon, W. Bush).

Information Technology/Communications

The rise of radio led into the peak before the Great Depression. Radio and "fireside chats" were the glue that held the nation together into the Depression. Similarly, Television led into the peak before Nixon with the Vietnam war being the first televised war. The rise of the Internet fed the boom that ended at the end of the Clinton presidency. Each time there was a new communication technology with greater bandwidth, there was a boom and then a bust.

Perhaps the new technology coupled with the cohort effect led to a new groupthink in that new communication channel and that led to each boom and the inevitable bust. For example: The new rising stars in the last boom were netizens. They communicated their enthusiasm through this new channel of communication that was largely denied to older folks who were not comfortable with computers and the internet. The young netizens were the wave of the future and they only really listened to each other in a groupthink one might even call a netthink. They were also largely responsible politically for the policies that led to the bust. The bust's trigger seemed to come from the discovery that the promise of the internet was below the netizens overblown expectations.

The Future

It is a striking pattern when taken in total view. What does it say about our future? If the patterns hold we can estimate the following:

Politics: We may expect that a strong parental figure with down to earth style and an aggressive stance toward Islamofascism or some other threat will be elected in 2012. Sarah Palin or someone like her would seem to fit the bill. While Obama is our FDR, Palin may be our Reagan for this next cycle. Those who are young adults now are more likely to become Conservatives. Obama will be as reviled as Carter and FDR, if not more.

Military: We would see the fall of Islamofascism or some other rising threat (China or the new Russia?) between 2016 and 2036. It would become a more obvious threat between now and 2012, and be an important theme for the next presidential election.

Stocks: We would not see a real noticeable turn around in the Dow/Au ratio until 2012, perhaps associated with the election. The Dow/Au ratio would be lower than in either the worst of the Carter stagflation or the Great Depression. While the drop would have about 20-30% more to go from here before hitting a pit sometime between 2009 and 2010, the recovery would take a few years and not really be a sure thing until after 2012.

If the dollar is inflated then the stock market may go up before the pit of the Dow/Au ratio. Thus the Dow could go up, but lose ground in real terms of gold. If the powers that be somehow manage to avoid inflation by raising interest rates, then business will stagnate, and the Dow will be restrained until the Dow/Au ratio bottom. Since Carter's situation was stagflation, then Obama's may be super-stagflation.

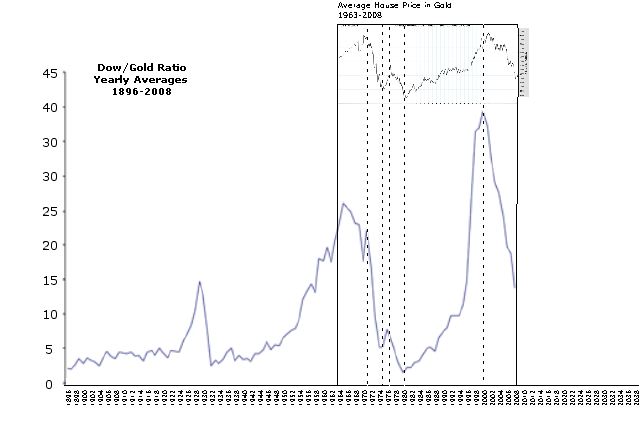

Housing: House prices follow a similar path to the Dow with respect to gold as shown in the following figure:

Housing prices appear to improve promptly after the bottom of previous pits, but the mortgage market may be distorted by the government. If the same pattern is followed we may see housing prices like they are now (in terms of gold) once again in 2023. We appear to have 20-30% more to fall in the housing market (unless there are some new market distortions from our government).

Information: One of the most interesting projections is in the area of information/communication technology. We may expect to see the rise of the next level in information interconnectedness and bandwidth: That can only be telepresence. With telepresence we will be able to not only talk to people elsewhere - it will feel like we are actually there. While it is not real and is completely virtual, there will be tremendous realism to the experience. This will be useful for not only recreation but for business, politics, and education. The need for people to be clustered in cities (which are attractive targets for Jihadis) will be reduced thanks to the enormous bandwidth and the emerging technologies of just "being there".

A Look Into the Future: Thus in the year 2036, we oldsters will be the voices of caution in a world gone mad with economic enthusiasm. We may me glad it is near the end of the term of a sex crazed party animal president who had terrible scandals for promiscuous things he was doing via telepresence. We would long for the days of the wholesome Palin presidency. We would see the internet as passe because now we would just "be" wherever we wanted to go. We would be glad the Islamofascists, New Russian and/or Chinese power was finally falling apart.

Even as we were relieved, a new evil would already be forming but largely ignored. New social problems with telepresence would be cropping up. We would be a prophetic voice in the wilderness as the next imminent economic crash would be heading toward us. A crash would be coming because the promise of telepresence was not enough to keep the unsustainable desires of people fulfilled in the real world.

But here we are now in 2009, with a Dow/Au ratio of about 7.14 (as of 3/9/09). We have already fallen most of the way down, but still have about 20-30% to fall. Even if there is a financial turn around, it will not be fast. Even if there is growth, we will not have the same Dow/Au ratio for over a decade. There will be more fear soon, and the Islamofascist or other threat must be confronted and defeated after 2012. That threat will become more obvious to even the most foolish among us in the next two years.

There will likely be inflation, which would raise house prices as well as gold. This depends to some extent on the Chinese who have the power to influence the credit markets and shift the balance between inflation and stagflation. How much inflation we get depends in part on how long the Chinese will be willing to buy our T-bills and prop up the Obama government. This introduces great volatility into the markets for the next decade and makes shorter term predictions important as wobbles in the ratio curve can last up to a year.

In the next article I will discuss these factors as we move forward, including China, inflation, stocks and gold strategies in the shorter term.