The World-Wide Government Bubble

This bubble of government makes all other economic bubbles that have come before seem puny by comparison. Furthermore, this bubble is uniquely world wide. As liquidity is running out and credit is drying up, many nations are in a chain reaction realizing the hot air on which their financial and political systems stand. In any case the dreams of Obama, the RINOs, and the Democrats will become painfully deflated as the era of big government comes to a close.

All bubbles come to an end when the liquidity is no longer available. After a certain point the bubble cannot be stopped by outside forces, but it does stop when the available resources are no longer available. It is like a fire that rages until the fuel is spent.

By all these measures, we have a Government Bubble that is popping.

Written by Dagny D'Anconia

Thursday 12 February 2008

Dot.com stocks and tulips are not the only things that can lead to financial bubbles. Governments can also be the focus of financial mania. Our global credit crisis is in reality a government bubble in the process of popping.

There are signs when a bubble exists:

1) On the face of it, a bubble looks illogical. You wonder are people crazy or are you just too old fashioned to understand. After all "It is hard to argue with success." People who buy into it are afraid of missing out when their friends and relatives are all benefiting. There is a herd instinct.

2) Money keeps flowing in to the system to keep it afloat. In this sense any bubble is a form of a Ponzi or pyramid scheme. The early adopters are kept profitable at the expense of the ones that later follow the fad. Even though there is no con-man mastermind behind it, the dynamic of the invisible hand is still at work as surely as if there were a con-man running it.

3) A bubble may have made some sense at the start, with some new product or technology at the root of it. However from that small and rational start the phenomenon takes on a life of its own. At that point the ramp up becomes near exponential.

The way markets are classically "supposed" to work is through a negative feedback on prices. If something is "overpriced" less people are willing to pay and the price comes down. Sometimes this negative feedback doesn't work, and the higher the price goes, the more people are willing to pay it. A positive feedback loop is created.

If a price surge is in progress and that has the psychological effect of validating itself, then a bubble is poised to form. There have been positive feedback bubbles for prices in real estate, tulips, beanie babies, dot.com stocks, and a myriad of other irrational exhuberances.

4) There is available time or income to keep the scheme going. Thus prosperity, large amounts of credit, and people with too much time on their hands can get their resources sucked up into a bubble mentality.

In our bubble, the banks were making absurd amounts of credit available in the belief that the Federal government would bail them out. Government also compelled banks to offer bad loans to key constituencies. Our government also made grandiose promises to provide social security, medicare etc.. Other nations were willing to keep reinvesting in American debt and dollars, perpetuating the bubble. All this was made possible because people believed in the greatness of the American government.

5) All bubbles come to an end when the liquidity is no longer available. After a certain point the bubble cannot be stopped by outside forces, but it does stop when the available resources are no longer available. It is like a fire that rages until the fuel is spent.

By all these measures, we have a Government Bubble that is popping.

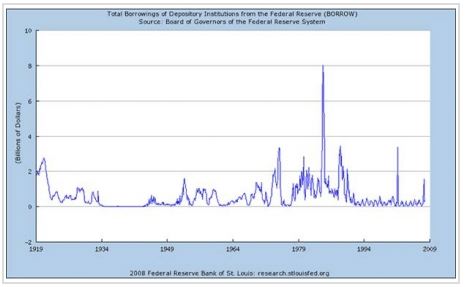

"Check out the following which shows the $$$ amount borrowed by US banks from the Fed through Dec 2007; the spike marks the Savings & Loan Crisis at the end of the 1980s with borrowing maxing out at $8b."

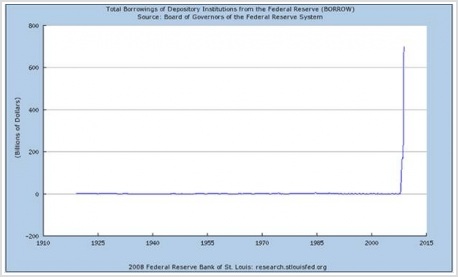

Below is the same graph as above, but updated through the beginning of November '08:

http://eastcoasteconomics.wordpress.com/page/2/

http://inflationdata.com/inflation/Hyperinflation_Articles/Hyperinflation_Bailout.asp

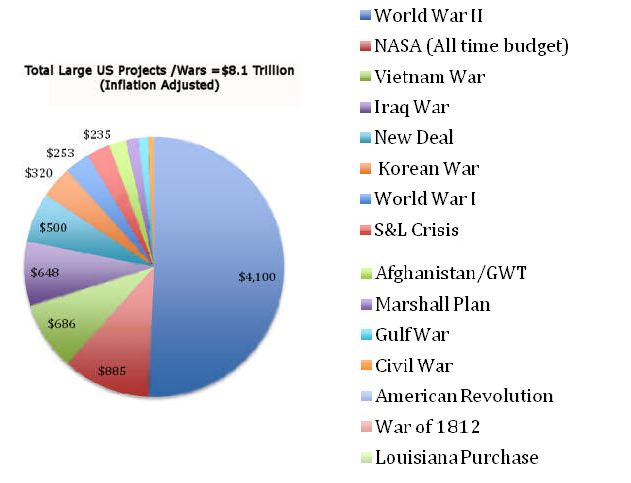

"In the span of a few weeks we went from pledging to spend $1 trillion to $3 trillion - a commitment which then grew to $5 trillion before ballooning to a staggering $8.5 trillion... As illustrated above, you can see that in today's dollars, we have already committed to spending levels that surpass the cumulative cost of all of the major wars and government initiatives since the American Revolution."

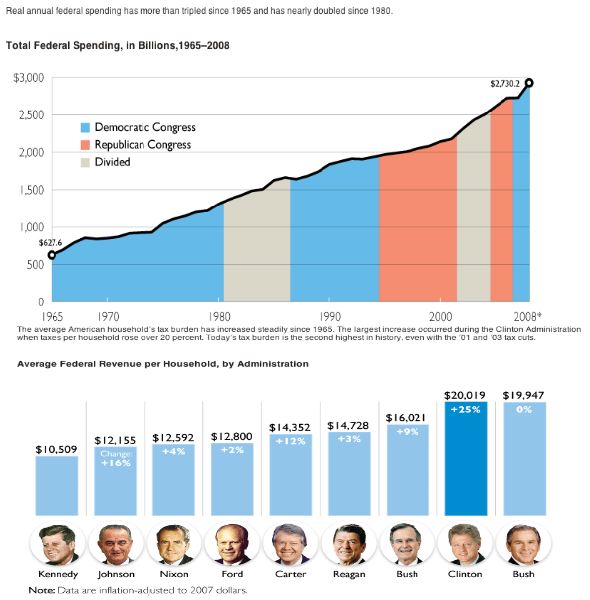

The rate at which the government is sucking up money has gone exponential. Under the name of "stimulus" and "bailout" they give money they don't have to their political cronies with only a fig leaf of a cover story. The conservatives are impotent to stop the phenomenon. The Grace Commission clearly sounded the alarm decades ago to no avail.

If you look at the rise in spending it is clear that it has gone on unabated, crossing Republican and Democrat Congresses and Administrations without any distinction. The phenomenon is beyond the political realm. The government bubble is an economic phenomenon that transcends politics.

Government revenue has become a positive feedback loop. Big government has become so financially successful that it is irresistible. Government money is indirectly and directly controlling the outcomes of elections through funding of pro-big-government schemes, corruption, and constituencies such as Acorn. The outcome of the election was economically preordained by the dynamics of the bubble. It had to be won by a big spending liberal.

It would be rational for the American government to see the financial abyss and cut taxes and spending, but this is something they cannot do. They cannot because this phenomenon is beyond politics. They can't stop what they are doing. Their power base demands it. The Democrats and RINO's were elected/selected because they were determined to do it. The voters demanded it. They are doomed to go over the cliff.

As you and I watch the unfolding of the Obama phenomenon, where pseudo-benevolent Leftists and big government are touted as the answer to all ills, we feel like we have been watching a mass lunacy. We have the classic feelings one has watching a bubble inflate. It has been frightening to see the madness of the crowd, the religious fervor of the faithful, the persecution of the heretics, the obscene absorption of power and money. It is a strange comfort that their insane vision for the future cannot be realized. With infinite money we all would have become slaves an ever growing state. Instead we will experience the government bubble pop.

Based on the Grace Commission findings, the bubble was predicted to pop back in 1995. The impending financial disaster was clearly laid out in the book Bankruptcy 1995. It was only the infusion of liquidity from foreign nations such as China and Japan that held off the day of reckoning. The authors could not believe that foreign nations would continue to buy T-bills - but they did. Economically it was an absurd thing, but politically it made sense: Countries like Japan and China thought they could gain control and dominance of America by financial means instead of military ones. Thus the authors of Bankruptcy 1995 were correct about the phenomenon, but off on the date.

Many have been wondering what can stop the insane juggernaut that is the Obama gravy train. The truth is after a certain point nothing can stop a bubble but itself. Just like bubbles that formed before, this government bubble could not be stopped by even the most determined and courageous patriots among us. When the liquidity runs out, the bubble pops and thus ends on its own. The liquidity is now near running out. The Democrat controlled Federal government is inevitably heading into more extravagance and unsustainability.

California is within weeks of a financial disaster and it is not alone. Britain, Iceland, South Korea, and Spain are also in dire trouble. China and Russia are both in financially difficult and thus politically unstable situations. Headlines now state "Downturn accelerates as it circles the globe. Economies worse off than analysts predicted just weeks ago." link

A bubble is a form of a Ponzi scheme and all the Ponzi schemes are now collapsing. These range from our huge Social Security pyramid to smaller Madoff type scams: "These [Ponzi] schemes rely on new people to be found and people aren't investing. People are hurting. And because people are hurting, they are seeking redemptions from what they think are these legitimate schemes," a Ponzi investigator said. "Between not having new investors and having old investors redeem, the Ponzi schemes are just collapsing." link People relying on the government for their retirement funds will feel as betrayed as the Madoff investors.

This is a financial storm that will affect all of us. Many on the government payroll will be cut. Many of our customers and customers of our employers are on the government payroll. Money for expansion and investment will be scarce. Democrats and RINOs will probably have to inflate the currency to keep their minions fed as the country tries to walk a precarious balance between inflation and depression. Gold and other commodities will be volatile as they gyrate between these two extremes. The turnip will be squeezed.

Bankruptcy 1995 cites many examples of similar government bubbles: "The charts [of Bolivia, Argentina and Brazil] show that in all three countries hyperinflation was preceded by a period of deflation. What the charts don't disclose is that the deflation in each of these countries began with plunging real estate values and then spread, a scenario similar to the one that we are experiencing today [written in 1992]."

In the past such bubbles popping were heralded by a drop in real estate values, followed by brief deflation, followed by inflation. Judging by their examples we would appear to be near the end of deflation and on our way to inflation.

California offers us a spyglass into the future. "As goes California so goes the nation" and this is even more true in this case because what is politically doable in California is likely to be doable in Washington DC.

California is hoping for a 21.8 billion bailout from the Federal Government to delay the inevitable. Nevertheless in California notice has been given that tax refund checks will be "delayed". Imagine the effect this will have on the filing of tax returns. Everyone will wait until April 15th and then the real drop in tax revenues will suddenly become apparent. Here is the latest on what will be cut first:

"Controller John Chiang, who acts as the state's accountant, said he will have no choice but to delay $3.7 billion in [tax refund] payments next month because the state is running out of cash. Doing so, he said, would buy the state a few more weeks before its accounts run dry. The state is on the brink of issuing IOUs as it faces a $41.6 billion shortfall over the next year-and-a-half. ... A severe drop in revenue from sales, property and capital gains taxes has left the state's main bank account depleted. The state has not had a positive cash balance since July 12, 2007, Chiang said. The state had been relying on borrowing from special funds and Wall Street investors, but those options are no longer available. Chiang said his office must continue $6.6 billion in education and debt payments next month but will defer money for tax refunds, student aid, social services and mental health programs... Paul McIntosh, executive director of the California State Association of Counties, said many counties already are low on reserves and may have to shut down welfare offices or end drug and mental health treatment programs at a time when applications are up 22 percent statewide." link

You know how crazy California is. How will the Lefty Obama adoring masses react when their mental health programs, special services, and student aid are cut? Folks with tax refunds seized will quietly fume and worry, but the others will take to the streets. What happens when there are additional expenses from these street protests and quasi riots? Will there be cutbacks in schools, police, and medical payments?

You can see where this is headed. Like any bubble, the disillusioned people are left with broken promises and worthless empty symbols of what might have been. When the police are stretched too thin, bad things happen. We will have to fend for ourselves and not look to the government for our rescue. While we can handle that, imagine how people will react who cannot even imagine a world without government keeping order.

When a government bubble pops, the value of government suddenly drops. With a few rebounds and jerks in opinion along the way, people gradually find contempt for the whole idea of investing in government either emotionally or financially. Government will become, to the masses, the bad joke it was to us all along. Few will trust it and most who do will be thought of as a deluded. This will probably happen world wide.

What can we do to prepare? The first thing we can do is be aware of the bubble. Accept the inevitable and profit if we can. Once we are at the top we can try to arrange our affairs so that government has as little impact directly and indirectly on us as possible. We should strive to look like an already squeezed turnip to the government and live as frugally and productively as possible.

Predicting how severe it will be is hard. We can see the inevitable direction, but not the depth of the pop or the recovery. Germany in 1923, Austria in 1922, Britain in 1979, and Argentina in 1989 provide examples of government euphoria, followed by deflation, followed by inflation. There was rampant corruption, lowered productivity and a lower standard of living. Recovery only followed cuts in government spending.

Rome fell from its own government bubble built up during extravagant reigns including Caligula, Claudius and Nero. While Rome was falling over several generations and was being sacked, some order was maintained out in the villages and monasteries. In the country people were capable of defense, production, and innovation on their own, and so life went on without centralized power. The great monuments to centralized power were not built, but the quiet business of life continued. Major cities then and now were the worst places to be since they have the most government dependence per capita. Cities may become relics of the past in the new era of global communications and commerce.

Britain was suffering from its own popped bubble when Margaret Thatcher rose to power. Her tough approach to cut spending earned her the name "Iron Lady" and she was the first woman to lead a major party in Britain. The Financial Times of London in 1992 credits Thatcher for saving England from remaining "the laughing stock of the Western World." Bankruptcy 1995 presciently notes in 1992 "If the United States has its own Margaret Thatcher, we haven't elected him or her to national office yet." Perhaps our own Iron Lady Palin will become the first woman to lead a major party in America.

Today's situation is somewhat different from Britain in the 1980's. Not only is the United States government bubble popping; Many other countries who subsidized the delay from 1995 to the present are seeing their own collapse and deflation. To some extent America has been too big to be allowed to fail until now. International financial policies complicate the timing and results as many currencies, markets and housing markets fall and inflate at different speeds.

This bubble of government makes all other economic bubbles that have come before seem puny by comparison. Furthermore, this bubble is uniquely world wide. As liquidity is running out and credit is drying up, many nations are in a chain reaction realizing the hot air on which their financial and political systems stand. In any case the dreams of Obama, the RINOs, and the Democrats will become painfully deflated as the era of big government comes to a close.

It may seem odd in this political climate to say big government will soon be a thing of the past, but it is. Like a decapitated chicken running mindlessly down the road, it just hasn't stopped moving yet.